|

CGS International Futures Malaysia Sdn Bhd

CGS International Futures Malaysia Sdn Bhd (“CGS International Futures Malaysia”) is a wholly owned subsidiary of CGS International Securities Malaysia Sdn Bhd ("CGS International Securities Malaysia").

Incorporated on 5 February 1993, CGS International Futures Malaysia, with a paid up capital of RM20,000,000, is a holder of a Capital Market Services License to carry on the business of dealing in derivatives. CGS International Futures Malaysia is also a trading participant of Bursa Malaysia Derivatives Bhd (“BMDB”) and a clearing participant of Bursa Malaysia Derivatives Clearing Bhd. CGS International Futures Malaysia provides full brokerage services for BMDB’s broad range of exchange listed derivatives products and facilitates trading in recognized foreign exchange listed derivatives products.

The Board of Directors (“The Board”) is collectively responsible for the proper stewardship of the company’s business and overall supervision of the activities of the company. The Board is responsible for putting in place a framework of good corporate governance including the processes of risk management, compliance and reporting. The Board and management team bring their diverse knowledge and experience in deliberations on issues pertaining to strategy, performance, resources and business conduct.

Board of Directors

Mr. Maxwell Ong Wai Boon

Maxwell is the Head of Securities and Leveraged Products of CGS International Futures Malaysia. Maxwell joined CIMB Futures Sdn Bhd in 2007 and has held positions in sales, marketing and dealing within the organisation.

With almost 40 years of experience in Malaysia and Singapore, Maxwell has accumulated vast knowledge in the derivatives industry.

Outside of CGS International Futures Malaysia, Maxwell also holds the position of the Vice President of Malaysian Futures Broker Association since 2022, where he is actively involved in bridging and representing the Clearing and Trading Participants for the overall derivatives industry growth.

He holds a Master’s Degree of Business Administration from Anglia Ruskin University, United Kingdom.

Mr. Vincent Wang Huanxing

Vincent holds multiple positions: Deputy CEO in CGS International Holdings Limited (“CGI”); Chief Risk Officer (“CRO”), co-Chief Financial Officer (“co-CFO”) and member of the Board of Directors in CGI’s wholly-owned subsidiaries, CGS International Securities Pte Ltd (“CGSI”); he also serves as one of the Board of Directors in another CGI’s wholly-owned subsidiary, CGS International Securities Group Malaysia Sdn Bhd, (parent of CGS International Securities Malaysia).

With a PhD in economics from the Chinese Academy of Sciences, and a Master's degree in law from China University of Political Science and Law, Vincent has over 19 years of comprehensive experience in the fields of finance, compliance and risk control in Capital Markets.

During his tenure as the Deputy CEO in CGI as well as CRO and co-CFO in CGSI, Vincent oversees all finance and risk management procedures, and has been working closely with regulators and exchanges in both Singapore and Hong Kong.

Ms. Chan Yuen May

Ms Chan Yuen May is the Deputy Group Chief Executive Officer (“Deputy GCEO”) and co-Group Chief Financial Officer.

Yuen May partners closely with the Group CEO in charting the business trajectory of the Group and is responsible for formulating the Group’s financial strategy in alignment with its overall business objectives. As part of her Deputy GCEO leadership mandate, Yuen May also provides management oversight in the areas of Governance, Compliance, Risk Management, Legal, IT Security & Governance and Internal Audit – key functions that govern the Group’s business transformation journey.

Throughout her tenure with the Group, Yuen May has been instrumental in the Group’s evolution, including its transition from CIMB-GK Securities to CGS-CIMB Securities, and finally CGS International in 2024, as well as various mergers & acquisitions and transformation programmes. Previously, Yuen May served as Group Chief Operating Officer and was responsible for the Group’s overall operations in areas such as Finance, Operations, Settlement, Technology and Credit Management.

She holds a Bachelor’s Degree in Business from the Charles Darwin University, Northern Australia.

Management

En. Khairi Shahrin Arief Bin Baki

En. Khairi joined CGS International Securities Malaysia as the Deputy CEO and Head of Global Sales. En. Khairi has held various senior positions prior to joining CGS International Securities Malaysia, such as Senior Vice President, Head of Digitalization at MIDF Group Bhd and CEO of i-VCAP Management. He had also played an integral role during his time at JP Morgan and Citigroup Global Markets where he built strong relationships with clients like EPF, PNB and KWAP.

Moving forward he will spearhead the CGS International Securities Malaysia sales and growth plans.

He holds a Bachelor’s Degree in Business Administration from Universiti Putra Malaysia.

Mr. Alan Inn Wei Loon

Alan is the Deputy CEO of CGS International Securities Malaysia. His work experience spanned as Group Head of Retail Services and Wealth Management, Managing Director and Regional Head of Retail Broking, Regional Head of Private Banking Products, Co-Head of Private Banking and Head of Investment – Private Banking, and Team Head/Financial Advisor – Private Banking at CIMB Investment Bank Berhad, and Head of Research at Dresdner Kleinwort Wasserstein Research Sdn Bhd, Kuala Lumpur.

Alan holds a Bachelor’s Degree in Business (Banking & Finance) 1st Class Honours and Bachelor’s Degree in Commerce from Monash University, Australia.

Mr. Maxwell Ong Wai Boon

As above.

Mr. Tasvinderjit Singh a/l Dedar Singh

Tasvinderjit is the Head of Futures of CGS International Futures Malaysia. He joined CIMB Futures Sdn Bhd in 1995.

He was one of the pioneer employees with over three decades of experience in derivatives markets and trading environment covering operations, sales, marketing and dealing. He has provided a wealth of knowledge in the field of listed derivatives and built a culture of reliability and trustworthiness in the sales and dealing team.

Tasvinderjit is primarily responsible for the growth and expansion of CGS International Futures Malaysia’ sales and dealing for both institutional and retail business operations.

He holds a Master's Degree of Business Administration from the University of the West of Scotland, United Kingdom.

Ms. Anne Wong Yew Fon

Anne joined CIMB Futures Sdn Bhd in 2009 and is the Head of Contracts for Difference (“CFD”) at CGS International Futures Malaysia. Prior to her appointment, she has spearheaded the retail derivatives division and was responsible for the sales, marketing and dealing functions for the company.

Anne has over 20 years of experience in the capital markets space including unit trusts, futures, options and CFDs. Before joining CIMB Futures Sdn Bhd, she was a Personal Financial Consultant with OCBC Bank and a licensed derivatives dealer with Kenanga Deutsche Futures Sdn Bhd.

As the Head of CFD, she is primarily responsible for the business development, expansion and financial performance of the CFD business in CGS International Futures Malaysia.

Anne received her Bachelor’s Degree in Business Administration (Hons) from Universiti Tunku Abdul Rahman. and holds a Master of Business Administration from Anglia Ruskin University, United Kingdom.

Pn. Norhanizah Mohd Nor

Pn. Norhanizah is the registered Compliance Officer for CGS MY and CGS MYF. She joined CIMB Futures Sdn Bhd in 2005 and has been in the derivatives industry for more than 20 years.

As the registered Compliance Officer for CGS MY and CGS MYF, Pn Norhanizah provides guidance and is responsible for the supervision of the compliance department with regulatory requirements for both equities and derivatives.

She holds a Bachelor’s Degree in Accountancy from Universiti Utara Malaysia. |

|

What are CFDs |

CFDs or Contracts for Difference are an agreement between two parties to exchange, at the close of the contract, the difference between the opening price and closing price of the contract, multiplied by the number of underlying stocks specified in the contract.

For CFDs on listed securities, they are traded in a similar way and can be used as an alternative instrument instead of trading on the underlying. It allows clients to gain exposure to stock price movements, without the need for ownership of the underlying stocks.

You will be able to take long or short positions on CFDs without paying the full contract value of the underlying position. You are only required to place a cash deposit (known as initial margin) as collateral.

CFDs do not have an expiry date and you will be able to hold the position indefinitely as long as you are able to meet your margin and interest requirements. |

|

|

|

Features & Benefits |

|

1. Flexibility to Short |

|

One of the main appeals of CFD trading is that you can short sell without owning the underlying stock. When you invest in a stock via a CFD on the CGS International Futures Malaysia CFD Trading System, you can open a short position on the spot at the real-time tradable price by selling with the aim of profiting from the falling stock price. |

|

|

|

2. Leverage |

|

CFDs are traded on margin, using leverage to maximise your trading capital. This means for a small outlay you can open larger positions in the market compared to that of traditional stock trading. |

|

|

|

3. No Expiry Date of Contracts |

|

Gives you the freedom to roll over your open positions on a daily basis until you choose to close the position. |

|

|

|

4. Transparent Pricing |

|

Our Direct Market Access system gives you the same transparent pricing and liquidity as stock trading. |

|

|

|

5. Ease of Trading |

|

There is more than one mode of trading CFDs - through broker or online. The online system for CFD trading includes features like good-for-the-day orders, real-time portfolio and daily account management. |

|

|

|

6. Corporate Action |

|

As an owner of an Equity CFD, you will have your account adjusted to reflect cash dividends credited or debited on the underlying stock and to participate in stock splits, just as you would if you owned the physical stock. The only difference is that with a CFD you are not entitled to any voting rights. |

|

|

|

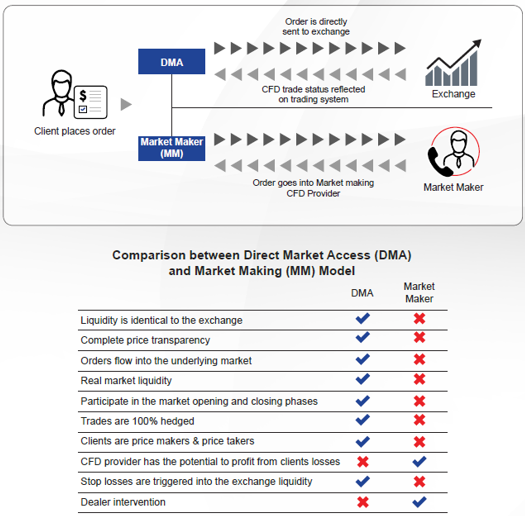

What is Direct Market Access? |

Direct Market Access (DMA), is the electronic facility that allows for CFD prices and liquidity to be identical to the underlying stock markets. Investors enter into CFDs at the underlying market price. This means that all orders are executed in real time and the investors can be assured of true market prices.

DMA also has the added benefit of offering the ability to participate in the pre-opening and pre-closing phase of the market, which is often the most liquid and volatile period of the trading day. CGS International Futures Malaysia adopts the DMA model for CFD as it offers one of the most transparent pricing structures to investors. |

|

|

|

DMA CFD provider model allows: |

-

No additional spreads

-

Straight through processing

-

Potential to be a price taker or maker

-

Participation in pre-opening and pre-closing phase

|

|

|

|

In comparison, the Market Maker (MM) CFD model: |

-

May not always have the same prices as the exchange

-

There is potential for additional spreads and potential requotes

-

Market makers are price takers only, generally there is no participation in pre-opening and pre-closing phase

|

|

|

|

|

|

Comparison of CFDs against Traditional Stock Trading |

|

CFD is traded on margin, using leverage to maximize your trading capital. This means that you can undertake a larger position for the same amount of capital as compared to traditional stock trading. The effect of leverage means that movements in the underlying market have a magnified effect and can result in greater profit or loss as illustrated below:- |

|

|

|

Example 1: A Profit-Making Trade |

|

|

CFD Trading |

Traditional Stock Trading |

|

|

Buy 1,000 XYZ CFD @ $10 |

Buy 1,000 XYZ Shares @ $10 |

|

Initial Outlay |

($1,000)

Upfront payment of 10% Margin is required |

($10,000)

Payment by settlement date is required |

|

Contract Value |

$10,000 |

$10,000 |

|

Commission @ 0.25% |

($25) |

($25) |

|

|

Sell 1,000 XYZ CFD @ $11 |

Sell 1,000 XYZ Shares @ $11 |

|

Contract Value |

$11,000 |

$11,000 |

|

Gross Profit/(Loss) |

$1,000 |

$1,000 |

|

Commission @ 0.25% |

($27.50) |

($27.50) |

|

Financing Cost * |

($5.48) |

- |

|

Net Profit/(Loss) |

($1,000 - $25 - $27.50 - $5.48)

= $942.02 |

($1,000 - $25 - $27.50)

= $947.50 |

|

Return on Initial Outlay |

$942.02 / $1,000 = 94.20% |

$947.5 / $10,000 = 9.48% |

|

|

|

|

Example 2: A Break-Even Trade

|

|

|

CFD Trading |

Traditional Stock Trading |

|

|

Buy 1,000 XYZ CFD @ $10 |

Buy 1,000 XYZ shares @ $10 |

|

Initial Outlay |

($1,000)

Upfront payment of 10% Margin is required |

($10,000)

Payment by settlement date is required |

|

Contract Value |

$10,000 |

$10,000 |

|

Commission @ 0.25% |

($25) |

($25) |

|

|

Sell 1,000 XYZ CFD @ $10 |

Sell 1,000 XYZ shares @ $10 |

|

Contract Value |

$10,000 |

$10,000 |

|

Gross Profit/(Loss) |

- |

- |

|

Commission @ 0.25% |

($25) |

($25) |

|

Financing Cost * |

($5.48) |

- |

|

Net Profit/(Loss) |

($0 - $25 - $25 - S5.48) = ($55.48) |

($0 - $25 - $25 ) = ($50) |

|

Return on Initial Outlay |

($55.48) / $1,000 = (5.548%) |

($50) / $10,000 = (0.5%) |

|

|

|

|

Example 3: A Loss-Making Trade |

|

|

CFD Trading |

Traditional Stock Trading |

|

|

Buy 1,000 XYZ CFD @ $10 |

Buy 1,000 XYZ shares @ $10 |

|

Initial Outlay |

($1,000)

Upfront payment of 10% Margin is required |

($10,000)

Payment by settlement date is required |

|

Contract Value |

$10,000 |

$10,000 |

|

Commission @ 0.25% |

($25) |

($25) |

|

|

Sell 1,000 XYZ CFD @ $9 |

Sell 1,000 XYZ shares @ $9 |

|

Contract Value |

$9,000 |

$9,000 |

|

Commission @ 0.25% |

($22.5) |

($22.5) |

|

Gross Profit/(Loss) |

($1,000) |

($1,000) |

|

Financing Cost * |

($5.48) |

- |

|

Net Profit/(Loss) |

(-$1,000 - $25 - $22.50 - $5.48)

= ($1,052.98) |

(-$1,000 - $25 - $22.50)

= ($1,047.50) |

|

Return on Initial Outlay |

($1,052.98) / $1,000 = (-105.30%) |

($1,047.50) / $10,000 = (-10.48%) |

* Note: The above illustrations assume the trade takes place on Friday and the subsequent sale takes place on the following Wednesday. Position is held for 5 days. Financing cost is determined at the CGS International Futures Malaysia Base Rate (“CBR”) plus 3.75% for long positions, and minus 3.75% for short positions. This example uses an effective financing rate of 4% per year / 365 days and assumes no change in valuation price on Monday and Tuesday. CBR is subject to change as it relates to the interbank quoted rate.

The risk of loss in CFD trading can be substantial and you may lose more than your initial investment. CFD investors are not the actual owners of the underlying instrument itself and do not have any rights over the underlying instrument. |

|

|

CFD TradingTraditional Stock Trading

Buy 1,000 XYZ CFD @ $10Buy 1,000 XYZ Shares @ $10Initial Outlay ($1,000)

Upfront payment of 10% Margin is required($10,000)

Payment by settlement date is requiredContract Value$10,000$10,000Commission @ 0.25%($25)($25)

Sell 1,000 XYZ CFD @ $11Sell 1,000 XYZ Shares @ $11Contract Value$11,000$11,000Gross Profit/(Loss)$1,000$1,000Commission @ 0.25%($27.50)($27.50)Financing Cost *($5.48)-Net Profit/(Loss)($1,000 - $25 - $27.50 - $5.48)

= $942.02($1,000 - $25 - $27.50)

= $947.50Return on Initial Outlay$942.02 / $1,000 = 94.20%$947.5 / $10,000 = 9.48%

CFD TradingTraditional Stock Trading

Buy 1,000 XYZ CFD @ $10Buy 1,000 XYZ Shares @ $10Initial Outlay ($1,000)

Upfront payment of 10% Margin is required($10,000)

Payment by settlement date is requiredContract Value$10,000$10,000Commission @ 0.25%($25)($25)

Sell 1,000 XYZ CFD @ $11Sell 1,000 XYZ Shares @ $11Contract Value$11,000$11,000Gross Profit/(Loss)$1,000$1,000Commission @ 0.25%($27.50)($27.50)Financing Cost *($5.48)-Net Profit/(Loss)($1,000 - $25 - $27.50 - $5.48)

= $942.02($1,000 - $25 - $27.50)

= $947.50Return on Initial Outlay$942.02 / $1,000 = 94.20%$947.5 / $10,000 = 9.48%

|

CFD Trading |

Traditional Stock Trading |

|

|

Buy 1,000 XYZ CFD @ $10 |

Buy 1,000 XYZ Shares @ $10 |

|

Initial Outlay |

($1,000)

Upfront payment of 10% Margin is required |

($10,000)

Payment by settlement date is required |

|

Contract Value |

$10,000 |

$10,000 |

|

Commission @ 0.25% |

($25) |

($25) |

|

|

Sell 1,000 XYZ CFD @ $11 |

Sell 1,000 XYZ Shares @ $11 |

|

Contract Value |

$11,000 |

$11,000 |

|

Gross Profit/(Loss) |

$1,000 |

$1,000 |

|

Commission @ 0.25% |

($27.50) |

($27.50) |

|

Financing Cost * |

($5.48) |

- |

|

Net Profit/(Loss) |

($1,000 - $25 - $27.50 - $5.48)

= $942.02 |

($1,000 - $25 - $27.50)

= $947.50 |

|

Return on Initial Outlay |

$942.02 / $1,000 = 94.20% |

$947.5 / $10,000 = 9.48%

|

|

Equities Markets |

|

Using our DMA platform, you can get ‘live’ data feeds from all the markets that we provide. Get the comprehensive list of counters and their useful related information from the following links* |

|

|

|

* CFD lists are indicative only. For the up-to-date list, please login to our platform and refer to the margin table. |

|

|

|

TRADING HOURS |

|

Country |

Exchange

Market |

Trading Hours |

Trading Hours

(Malaysia Time) |

Trading Hours

(Malaysia Time during daylight

savings*) |

|

Singapore |

SGX |

Pre-opening: 8.30am - (8.58am -

8.59am)

Non-Cancel: (8.58am - 8.59am) -

9.00am

Trading: 9.00am - 12.00pm

Lunch: 12.00pm - 1.00pm

Trading: 1.00pm - 5.00pm

Pre-closing: 5.00pm - (5.04pm -

5.05pm)

Non-Cancel: (5.04pm - 5.05pm) -

5.06pm

Trade at Close: 5.06pm - 5.16pm

|

SAME |

N.A. |

Hong

Kong |

HKSE |

Trading: 9.30am - 12.00pm

Lunch: 12.00pm - 1.00pm

Trading: 1.00pm - 4.00pm

Reference Price Fixing: 4.00pm –

4.01pm

Order Input: 4.01pm – 4.06pm

No Cancellation: 4.06pm – 4.08pm

Random Closing: 4.08pm –

4.10pm

|

SAME |

N.A. |

|

USA |

NYSE &

NASDAQ

|

9.30 am – 4.00 pm |

10.30 pm – 5.00 am |

9.30 pm – 4.00 am |

|

Australia |

ASX |

Pre-opening: 7.00am - 10.00am

Trading: 10.00am - 4.00pm

Pre-CSPA: 4:00pm - 4:10pm

Closing Single Price Auction: 4.10pm - 4.12pm

|

Pre-opening: 5.00am - 8.00am

Trading: 8.00am - 2.00pm

Pre-CSPA: 2:00pm - 2:10pm

Closing Single Price Auction: 2.10pm - 2.12pm |

Pre-opening: 4.00am - 7.00am

Trading: 7.00am - 1.00pm

Pre-CSPA: 1:00pm - 1:10pm

Closing Single Price Auction: 1.10pm - 1.12pm |

|

|

*US Daylight Saving Time - begins each year at 2 a.m. on the second Sunday of March and ends at 2 a.m. on the first Sunday of November. |

|

*Australia Daylight Saving Time - begins at 2am (AEST) on the first Sunday in October and ends at 2am (AEST) (which is 3am Australian Eastern Daylight Time) on the first Sunday in April. |

|

|

|

Cash Index CFD |

CGS-CIMB Futures Cash Index CFD allows you to trade the world’s leading indices.

The price of the Cash Index CFD is directly related to the underlying index and is derived by adjusting the Futures price by Fair Value to account for interest and dividends.

You can take a long or short view of the market and potentially profit from a move in either direction.

Using Index CFD to short the market in one trade is a great way to hedge your equity portfolio quickly and easily in times of doubt.

Trade the world's global markets, commission free via our Index CFDs. Trade long, short or even hedge your existing share portfolio with the click of a button.

Margin rates start from as low as 5% for major indices. |

|

|

|

Advantages of Cash Index CFD |

-

Transparent price, tight spreads and substantial liquidity provided by our liquidity provider

-

Clients can now trade multiple asset types in single trading account (Equity CFD & Index CFD)

-

No commission cost

-

Cash settled and non-expiring

-

No hidden expiry rollover cost

-

Minimum trade size of 1 index available except on JP225.

-

Contract value are lower than actual Index Futures therefore provides flexibility to speculate or hedge existing equity portfolio against macro market events

|

|

|

|

Cash Index CFD Product List |

Index

Code |

Underlyng

Reference

Index |

Index

Currency

* |

Traget

Spread

* |

Margin

* |

Financing

Days |

Min

Trade

Size |

Trading

Hours

(GMT) |

Order

Types |

|

AX200.IXC |

Australia

200 |

AUD |

1 |

5% |

365 |

1 |

Trading:

23.50 - 21.00

Break:

06.30 - 07.10

21.00 - 23.50 |

Price

Instruction:

Market, Limit, Stop

Lifetime

Instruction:

Good till Cancel, Date

CO Orders:

OCO, FIXEDCO, Trailing CO

|

|

CN.H.IXC |

China

H-SHARES |

HKD |

6 |

5% |

365 |

1 |

Trading:

01.15 - 19.00

Break:

04.00 - 05.00

08.30 - 09.15

19.00 - 01.15 |

|

CNA50.IXC |

China A50 |

USD |

3 |

20% |

360 |

1 |

Trading:

01.00 - 20.45

Break:

08.30 - 09.00

20.45 - 01.00 |

|

EX50.IXC |

Euro

Stoxx 50 |

EUR |

2 |

10% |

360 |

1 |

Trading:

00.15 - 20.00

Break:

20.00 - 00.15 |

|

FR40.IXC |

France

CAC 40 |

EUR |

1 |

5% |

360 |

1 |

Trading:

06.00 - 20.00

Break:

20.00 - 06.00 |

|

GR30.IXC |

Germany DAX 30 |

EUR |

1 |

5% |

360 |

1 |

Trading:

00.15 - 20.00

Break:

20.00 - 00.15 |

|

HK50.IXC |

Hong Kong Hang Seng |

HKD |

5 |

5% |

365 |

1 |

Trading:

01.15 - 19.00

Break:

04.00 - 05.00

08.30 - 09.15

19.00 - 01.15 |

|

JP225.IXC |

Japan

Nikkei 225 |

JPY |

8 |

5% |

365 |

10 |

Trading:

22.00 - 21.00

Break:

21.00 - 22.00 |

|

SING.IXC |

Singapore 30 |

SGD |

0.4 |

5% |

365 |

1 |

Trading:

00.30 - 20.45

Break:

09.10 - 09.40

20.45 - 00.30 |

|

UK100.IXC |

UK

FTSE 100 |

GBP |

1 |

5% |

365 |

1 |

Trading:

00.00 - 20.00

Break:

20.00 - 00.00 |

|

US30.IXC |

US

Dow Jones |

USD |

2 |

5% |

360 |

1 |

Trading:

22.00 - 21.00

Break:

20.15 - 20.30

21.00 - 22.00 |

|

USTEC.IXC |

US Nasdaq |

USD |

2 |

5% |

360 |

1 |

Trading:

22.00 - 21.00

Break:

20.15 - 20.30

21.00 - 22.00

|

|

US500.IXC |

US S&P |

USD |

2 |

5% |

360 |

1 |

Trading:

22.00 - 21.00

Break:

20.15 - 20.30

21.00 - 22.00 |

|

|

Trading Hours are subject to change due to Daylight Savings

|

|

*Index Currency – All profit/loss, financing and dividends will be posted in the index currency

*Target Spread – Bid/Ask spread during peak trading hours. Spreads may vary during off peak hours and certain market events

*Margin – Margin rates are subjected to change in case of volatile market conditions. Please refer to Margin Table in trading platform for latest rates |

|

|

Cash Index CFD Live market data is free and available to all CFD customers via our trading platform. Just type in /CFDINDEX in your quote screen to see live quotes for Cash Index CFD. |

|

|

|

|

|

Trading Scenarios |

|

Click here for Trading Examples

Click here for Financing Examples

Click here for Dividend Examples |

|

|

|

|

|

Getting Started with Cash Index CFD |

|

If you are an existing client, you will be able to trade Cash Index CFDs. Click on "Margin Table" button in your trading platform and search for the "IXC" Exchange

However, if "IXC" Exchange is not available in your trading platform margin table, please contact your Futures Broker’s Representative or email us at [email protected] for assistance. |

|

|

|

|

|

Commission & Financing Rates |

|

|

Commission is charged on each CFD trade and is calculated as a percentage of the full contract value of the underlying stock that is bought or sold. Financing is charged daily on any CFD position held overnight. |

|

|

|

|

|

Data Feed Charges |

|

Investors trading in other foreign market CFDs are required to subscribe for foreign market data feed.

Please click on the following schedule for details. |

|

|

|

|

|

Commission, Financing and Market Data Charges |

|

|

Equities Markets |

|

Using our DMA platform, you can get ‘live’ data feeds from all the markets that we provide. Get the comprehensive list of counters and their useful related information from the following links* |

|

|

|

* CFD lists are indicative only. For the up-to-date list, please login to our platform and refer to the margin table. |

|

|

|

TRADING HOURS |

|

Country |

Exchange

Market |

Trading Hours |

Trading Hours

(Malaysia Time) |

Trading Hours

(Malaysia Time during daylight

savings*) |

|

Malaysia |

KLS |

Pre-opening:

8.30am – 9.00am

Trading:

9.00am - 12.30pm

Lunch:

12.30pm - 2.00pm

Pre-opening:

2.00pm – 2.30pm

Trading:

2.30pm – 4.45pm

Pre-closing:

4.45pm

Closing

4.50pm

Trading at Last

4.50pm – 5.00pm

|

SAME |

N.A. |

|

Singapore |

SGX |

Pre-opening:

8.30am

Non-Cancel:

8.58am - 8.59am

Trading:

9.00am - 12.00pm

Lunch:

12.00pm - 1.00pm

Trading:

1.00pm - 5.00pm

Pre-closing:

5.00pm

Non-Cancel:

5.04pm - 5.05pm

Trade at Close:

5.06pm - 5.16pm

|

SAME |

N.A. |

|

Hong Kong |

HKSE |

Order Input Period:

9.00am – 9.15am

No-Cancellation Period:

9.15am – 9.20am

Random Matching Period:

9.20am – 9.22am

Blocking Period:

After random matching – 9:30am

Trading:

9.30am - 12.00pm

Lunch:

12.00pm - 1.00pm

Trading:

1.00pm - 4.00pm

Reference Price Fixing: 4.00pm – 4.01pm

Order Input:

4.01pm – 4.06pm

No Cancellation:

4.06pm – 4.08pm

Random Closing:

4.08pm – 4.10pm

|

SAME |

N.A. |

|

USA |

NYSE

NASDAQ

|

Pre-Market Trading:

4.00 am – 9.30 am

(Limit orders only)

Continuous Trading:

9.30 am – 4.00 pm

Post Market Trading:

4.00 pm – 5.00 pm

(Limit orders only)

|

Pre-Market Trading:

5.00 pm –10.30 pm

(Limit orders only)

Continuous Trading:

10.30 pm – 5.00 am

Post Market Trading:

5.00 am –6.00am

(Limit orders only) |

Pre-Market Trading:

4.00 pm – 9.30pm

(Limit orders only)

Continuous Trading:

9.30 pm – 4.00 am

Post Market Trading:

4.00 am to 5.00 am

(Limit orders only) |

|

Australia |

ASX |

Pre-opening:

7.00am - 10.00am

Trading:

10.00am - 4.00pm

Pre-CSPA:

4:00pm - 4:10pm

Closing Single Price Auction:

4.10pm - 4.12pm

|

Pre-opening:

5.00am - 8.00am

Trading:

8.00am - 2.00pm

Pre-CSPA:

2:00pm - 2:10pm

Closing Single Price Auction:

2.10pm - 2.12pm |

Pre-opening:

4.00am - 7.00am

Trading:

7.00am - 1.00pm

Pre-CSPA:

1:00pm - 1:10pm

Closing Single Price Auction:

1.10pm - 1.12pm |

|

China |

SHG

(Shanghai) |

Pre-opening:

9.15am - 9.25am

Trading:

9.30am - 11.30am

Lunch:

11.30am - 1:00pm

Trading:

1.00pm - 2.57pm

Closing Call Auction:

2.57pm - 3.00pm |

SAME |

N.A. |

|

|

*US Daylight Saving Time - begins each year at 2 a.m. on the second Sunday of March and ends at 2 a.m. on the first Sunday of November. |

|

*Australia Daylight Saving Time - begins at 2am (AEST) on the first Sunday in October and ends at 2am (AEST) (which is 3am Australian Eastern Daylight Time) on the first Sunday in April. |

|

|

|

|

|

|

|

|

|

Commission & Financing Rates |

|

Commission is charged on each CFD trade and is calculated as a percentage of the full contract value of the underlying stock that is bought or sold. Financing is charged daily on any CFD position held overnight. |

|

|

|

Data Feed Charges |

Investors trading in other foreign market CFDs are required to subscribe for foreign market data feed.

Please click on the following schedule for details. |

|

|

|

Commission, Financing and Market Data Charges |

|

Equities Markets |

|

Using our DMA platform, you can get ‘live’ data feeds from all the markets that we provide. Get the comprehensive list of counters and their useful related information from the following links* |

|

|

|

* CFD lists are indicative only. For the up-to-date list, please login to our platform and refer to the margin table. |

|

|

|

TRADING HOURS |

|

Country |

Exchange

Market |

Trading Hours |

Trading Hours

(Malaysia Time) |

Trading Hours

(Malaysia Time during daylight

savings*) |

|

Singapore |

SGX |

Pre-opening: 8.30am - (8.58am -

8.59am)

Non-Cancel: (8.58am - 8.59am) -

9.00am

Trading: 9.00am - 12.00pm

Lunch: 12.00pm - 1.00pm

Trading: 1.00pm - 5.00pm

Pre-closing: 5.00pm - (5.04pm -

5.05pm)

Non-Cancel: (5.04pm - 5.05pm) -

5.06pm

Trade at Close: 5.06pm - 5.16pm

|

SAME |

N.A. |

Hong

Kong |

HKSE |

Trading: 9.30am - 12.00pm

Lunch: 12.00pm - 1.00pm

Trading: 1.00pm - 4.00pm

Reference Price Fixing: 4.00pm –

4.01pm

Order Input: 4.01pm – 4.06pm

No Cancellation: 4.06pm – 4.08pm

Random Closing: 4.08pm –

4.10pm

|

SAME |

N.A. |

|

USA |

NYSE &

NASDAQ

|

9.30 am – 4.00 pm |

10.30 pm – 5.00 am |

9.30 pm – 4.00 am |

|

Australia |

ASX |

Pre-opening: 7.00am - 10.00am

Trading: 10.00am - 4.00pm

Pre-CSPA: 4:00pm - 4:10pm

Closing Single Price Auction: 4.10pm - 4.12pm

|

Pre-opening: 5.00am - 8.00am

Trading: 8.00am - 2.00pm

Pre-CSPA: 2:00pm - 2:10pm

Closing Single Price Auction: 2.10pm - 2.12pm |

Pre-opening: 4.00am - 7.00am

Trading: 7.00am - 1.00pm

Pre-CSPA: 1:00pm - 1:10pm

Closing Single Price Auction: 1.10pm - 1.12pm |

|

|

*US Daylight Saving Time - begins each year at 2 a.m. on the second Sunday of March and ends at 2 a.m. on the first Sunday of November. |

|

*Australia Daylight Saving Time - begins at 2am (AEST) on the first Sunday in October and ends at 2am (AEST) (which is 3am Australian Eastern Daylight Time) on the first Sunday in April. |

|

|

|

Cash Index CFD |

CGS-CIMB Futures Cash Index CFD allows you to trade the world’s leading indices.

The price of the Cash Index CFD is directly related to the underlying index and is derived by adjusting the Futures price by Fair Value to account for interest and dividends.

You can take a long or short view of the market and potentially profit from a move in either direction.

Using Index CFD to short the market in one trade is a great way to hedge your equity portfolio quickly and easily in times of doubt.

Trade the world's global markets, commission free via our Index CFDs. Trade long, short or even hedge your existing share portfolio with the click of a button.

Margin rates start from as low as 5% for major indices. |

|

|

|

Advantages of Cash Index CFD |

-

Transparent price, tight spreads and substantial liquidity provided by our liquidity provider

-

Clients can now trade multiple asset types in single trading account (Equity CFD & Index CFD)

-

No commission cost

-

Cash settled and non-expiring

-

No hidden expiry rollover cost

-

Minimum trade size of 1 index available except on JP225.

-

Contract value are lower than actual Index Futures therefore provides flexibility to speculate or hedge existing equity portfolio against macro market events

|

|

|

|

Cash Index CFD Product List |

Index

Code |

Underlyng

Reference

Index |

Index

Currency

* |

Traget

Spread

* |

Margin

* |

Financing

Days |

Min

Trade

Size |

Trading

Hours

(GMT) |

Order

Types |

|

AX200.IXC |

Australia

200 |

AUD |

1 |

5% |

365 |

1 |

Trading:

23.50 - 21.00

Break:

06.30 - 07.10

21.00 - 23.50 |

Price

Instruction:

Market, Limit, Stop

Lifetime

Instruction:

Good till Cancel, Date

CO Orders:

OCO, FIXEDCO, Trailing CO

|

|

CN.H.IXC |

China

H-SHARES |

HKD |

6 |

5% |

365 |

1 |

Trading:

01.15 - 19.00

Break:

04.00 - 05.00

08.30 - 09.15

19.00 - 01.15 |

|

CNA50.IXC |

China A50 |

USD |

3 |

20% |

360 |

1 |

Trading:

01.00 - 20.45

Break:

08.30 - 09.00

20.45 - 01.00 |

|

EX50.IXC |

Euro

Stoxx 50 |

EUR |

2 |

10% |

360 |

1 |

Trading:

00.15 - 20.00

Break:

20.00 - 00.15 |

|

FR40.IXC |

France

CAC 40 |

EUR |

1 |

5% |

360 |

1 |

Trading:

06.00 - 20.00

Break:

20.00 - 06.00 |

|

GR30.IXC |

Germany DAX 30 |

EUR |

1 |

5% |

360 |

1 |

Trading:

00.15 - 20.00

Break:

20.00 - 00.15 |

|

HK50.IXC |

Hong Kong Hang Seng |

HKD |

5 |

5% |

365 |

1 |

Trading:

01.15 - 19.00

Break:

04.00 - 05.00

08.30 - 09.15

19.00 - 01.15 |

|

JP225.IXC |

Japan

Nikkei 225 |

JPY |

8 |

5% |

365 |

10 |

Trading:

22.00 - 21.00

Break:

21.00 - 22.00 |

|

SING.IXC |

Singapore 30 |

SGD |

0.4 |

5% |

365 |

1 |

Trading:

00.30 - 20.45

Break:

09.10 - 09.40

20.45 - 00.30 |

|

UK100.IXC |

UK

FTSE 100 |

GBP |

1 |

5% |

365 |

1 |

Trading:

00.00 - 20.00

Break:

20.00 - 00.00 |

|

US30.IXC |

US

Dow Jones |

USD |

2 |

5% |

360 |

1 |

Trading:

22.00 - 21.00

Break:

20.15 - 20.30

21.00 - 22.00 |

|

USTEC.IXC |

US Nasdaq |

USD |

2 |

5% |

360 |

1 |

Trading:

22.00 - 21.00

Break:

20.15 - 20.30

21.00 - 22.00

|

|

US500.IXC |

US S&P |

USD |

2 |

5% |

360 |

1 |

Trading:

22.00 - 21.00

Break:

20.15 - 20.30

21.00 - 22.00 |

|

|

Trading Hours are subject to change due to Daylight Savings

|

|

*Index Currency – All profit/loss, financing and dividends will be posted in the index currency

*Target Spread – Bid/Ask spread during peak trading hours. Spreads may vary during off peak hours and certain market events

*Margin – Margin rates are subjected to change in case of volatile market conditions. Please refer to Margin Table in trading platform for latest rates |

|

|

Cash Index CFD Live market data is free and available to all CFD customers via our trading platform. Just type in /CFDINDEX in your quote screen to see live quotes for Cash Index CFD. |

|

|

|

|

|

Trading Scenarios |

|

Click here for Trading Examples

Click here for Financing Examples

Click here for Dividend Examples |

|

|

|

|

|

Getting Started with Cash Index CFD |

|

If you are an existing client, you will be able to trade Cash Index CFDs. Click on "Margin Table" button in your trading platform and search for the "IXC" Exchange

However, if "IXC" Exchange is not available in your trading platform margin table, please contact your Futures Broker’s Representative or email us at [email protected] for assistance. |

|

|

|

|

|

Commission & Financing Rates |

|

|

Commission is charged on each CFD trade and is calculated as a percentage of the full contract value of the underlying stock that is bought or sold. Financing is charged daily on any CFD position held overnight. |

|

|

|

|

|

Data Feed Charges |

|

Investors trading in other foreign market CFDs are required to subscribe for foreign market data feed.

Please click on the following schedule for details. |

|

|

|

|

|

Commission, Financing and Market Data Charges |

|

|

Equities Markets |

|

Using our DMA platform, you can get ‘live’ data feeds from all the markets that we provide. Get the comprehensive list of counters and their useful related information from the following links* |

|

|

|

* CFD lists are indicative only. For the up-to-date list, please login to our platform and refer to the margin table. |

|

|

|

TRADING HOURS |

|

Country |

Exchange

Market |

Trading Hours |

Trading Hours

(Malaysia Time) |

Trading Hours

(Malaysia Time during daylight

savings*) |

|

Singapore |

SGX |

Pre-opening: 8.30am - (8.58am -

8.59am)

Non-Cancel: (8.58am - 8.59am) -

9.00am

Trading: 9.00am - 12.00pm

Lunch: 12.00pm - 1.00pm

Trading: 1.00pm - 5.00pm

Pre-closing: 5.00pm - (5.04pm -

5.05pm)

Non-Cancel: (5.04pm - 5.05pm) -

5.06pm

Trade at Close: 5.06pm - 5.16pm

|

SAME |

N.A. |

Hong

Kong |

HKSE |

Trading: 9.30am - 12.00pm

Lunch: 12.00pm - 1.00pm

Trading: 1.00pm - 4.00pm

Reference Price Fixing: 4.00pm –

4.01pm

Order Input: 4.01pm – 4.06pm

No Cancellation: 4.06pm – 4.08pm

Random Closing: 4.08pm –

4.10pm

|

SAME |

N.A. |

|

USA |

NYSE &

NASDAQ

|

9.30 am – 4.00 pm |

10.30 pm – 5.00 am |

9.30 pm – 4.00 am |

|

Australia |

ASX |

Pre-opening: 7.00am - 10.00am

Trading: 10.00am - 4.00pm

Pre-CSPA: 4:00pm - 4:10pm

Closing Single Price Auction: 4.10pm - 4.12pm

|

Pre-opening: 5.00am - 8.00am

Trading: 8.00am - 2.00pm

Pre-CSPA: 2:00pm - 2:10pm

Closing Single Price Auction: 2.10pm - 2.12pm |

Pre-opening: 4.00am - 7.00am

Trading: 7.00am - 1.00pm

Pre-CSPA: 1:00pm - 1:10pm

Closing Single Price Auction: 1.10pm - 1.12pm |

|

|

*US Daylight Saving Time - begins each year at 2 a.m. on the second Sunday of March and ends at 2 a.m. on the first Sunday of November. |

|

*Australia Daylight Saving Time - begins at 2am (AEST) on the first Sunday in October and ends at 2am (AEST) (which is 3am Australian Eastern Daylight Time) on the first Sunday in April. |

|

|

|

Cash Index CFD |

CGS-CIMB Futures Cash Index CFD allows you to trade the world’s leading indices.

The price of the Cash Index CFD is directly related to the underlying index and is derived by adjusting the Futures price by Fair Value to account for interest and dividends.

You can take a long or short view of the market and potentially profit from a move in either direction.

Using Index CFD to short the market in one trade is a great way to hedge your equity portfolio quickly and easily in times of doubt.

Trade the world's global markets, commission free via our Index CFDs. Trade long, short or even hedge your existing share portfolio with the click of a button.

Margin rates start from as low as 5% for major indices. |

|

|

|

Advantages of Cash Index CFD |

-

Transparent price, tight spreads and substantial liquidity provided by our liquidity provider

-

Clients can now trade multiple asset types in single trading account (Equity CFD & Index CFD)

-

No commission cost

-

Cash settled and non-expiring

-

No hidden expiry rollover cost

-

Minimum trade size of 1 index available except on JP225.

-

Contract value are lower than actual Index Futures therefore provides flexibility to speculate or hedge existing equity portfolio against macro market events

|

|

|

|

Cash Index CFD Product List |

Index

Code |

Underlyng

Reference

Index |

Index

Currency

* |

Traget

Spread

* |

Margin

* |

Financing

Days |

Min

Trade

Size |

Trading

Hours

(GMT) |

Order

Types |

|

AX200.IXC |

Australia

200 |

AUD |

1 |

5% |

365 |

1 |

Trading:

23.50 - 21.00

Break:

06.30 - 07.10

21.00 - 23.50 |

Price

Instruction:

Market, Limit, Stop

Lifetime

Instruction:

Good till Cancel, Date

CO Orders:

OCO, FIXEDCO, Trailing CO

|

|

CN.H.IXC |

China

H-SHARES |

HKD |

6 |

5% |

365 |

1 |

Trading:

01.15 - 19.00

Break:

04.00 - 05.00

08.30 - 09.15

19.00 - 01.15 |

|

CNA50.IXC |

China A50 |

USD |

3 |

20% |

360 |

1 |

Trading:

01.00 - 20.45

Break:

08.30 - 09.00

20.45 - 01.00 |

|

EX50.IXC |

Euro

Stoxx 50 |

EUR |

2 |

10% |

360 |

1 |

Trading:

00.15 - 20.00

Break:

20.00 - 00.15 |

|

FR40.IXC |

France

CAC 40 |

EUR |

1 |

5% |

360 |

1 |

Trading:

06.00 - 20.00

Break:

20.00 - 06.00 |

|

GR30.IXC |

Germany DAX 30 |

EUR |

1 |

5% |

360 |

1 |

Trading:

00.15 - 20.00

Break:

20.00 - 00.15 |

|

HK50.IXC |

Hong Kong Hang Seng |

HKD |

5 |

5% |

365 |

1 |

Trading:

01.15 - 19.00

Break:

04.00 - 05.00

08.30 - 09.15

19.00 - 01.15 |

|

JP225.IXC |

Japan

Nikkei 225 |

JPY |

8 |

5% |

365 |

10 |

Trading:

22.00 - 21.00

Break:

21.00 - 22.00 |

|

SING.IXC |

Singapore 30 |

SGD |

0.4 |

5% |

365 |

1 |

Trading:

00.30 - 20.45

Break:

09.10 - 09.40

20.45 - 00.30 |

|

UK100.IXC |

UK

FTSE 100 |

GBP |

1 |

5% |

365 |

1 |

Trading:

00.00 - 20.00

Break:

20.00 - 00.00 |

|

US30.IXC |

US

Dow Jones |

USD |

2 |

5% |

360 |

1 |

Trading:

22.00 - 21.00

Break:

20.15 - 20.30

21.00 - 22.00 |

|

USTEC.IXC |

US Nasdaq |

USD |

2 |

5% |

360 |

1 |

Trading:

22.00 - 21.00

Break:

20.15 - 20.30

21.00 - 22.00

|

|

US500.IXC |

US S&P |

USD |

2 |

5% |

360 |

1 |

Trading:

22.00 - 21.00

Break:

20.15 - 20.30

21.00 - 22.00 |

|

|

Trading Hours are subject to change due to Daylight Savings

|

|

*Index Currency – All profit/loss, financing and dividends will be posted in the index currency

*Target Spread – Bid/Ask spread during peak trading hours. Spreads may vary during off peak hours and certain market events

*Margin – Margin rates are subjected to change in case of volatile market conditions. Please refer to Margin Table in trading platform for latest rates |

|

|

Cash Index CFD Live market data is free and available to all CFD customers via our trading platform. Just type in /CFDINDEX in your quote screen to see live quotes for Cash Index CFD. |

|

|

|

|

|

Trading Scenarios |

|

Click here for Trading Examples

Click here for Financing Examples

Click here for Dividend Examples |

|

|

|

|

|

Getting Started with Cash Index CFD |

|

If you are an existing client, you will be able to trade Cash Index CFDs. Click on "Margin Table" button in your trading platform and search for the "IXC" Exchange

However, if "IXC" Exchange is not available in your trading platform margin table, please contact your Futures Broker’s Representative or email us at [email protected] for assistance. |

|

|

|

|

|

Commission & Financing Rates |

|

|

Commission is charged on each CFD trade and is calculated as a percentage of the full contract value of the underlying stock that is bought or sold. Financing is charged daily on any CFD position held overnight. |

|

|

|

|

|

Data Feed Charges |

|

Investors trading in other foreign market CFDs are required to subscribe for foreign market data feed.

Please click on the following schedule for details. |

|

|

|

|

|

Commission, Financing and Market Data Charges |

|

|

Equities Markets |

|

Using our DMA platform, you can get ‘live’ data feeds from all the markets that we provide. Get the comprehensive list of counters and their useful related information from the following links* |

|

|

|

* CFD lists are indicative only. For the up-to-date list, please login to our platform and refer to the margin table. |

|

|

|

TRADING HOURS |

|

Country |

Exchange

Market |

Trading Hours |

Trading Hours

(Malaysia Time) |

Trading Hours

(Malaysia Time during daylight

savings*) |

|

Singapore |

SGX |

Pre-opening: 8.30am - (8.58am -

8.59am)

Non-Cancel: (8.58am - 8.59am) -

9.00am

Trading: 9.00am - 12.00pm

Lunch: 12.00pm - 1.00pm

Trading: 1.00pm - 5.00pm

Pre-closing: 5.00pm - (5.04pm -

5.05pm)

Non-Cancel: (5.04pm - 5.05pm) -

5.06pm

Trade at Close: 5.06pm - 5.16pm

|

SAME |

N.A. |

Hong

Kong |

HKSE |

Trading: 9.30am - 12.00pm

Lunch: 12.00pm - 1.00pm

Trading: 1.00pm - 4.00pm

Reference Price Fixing: 4.00pm –

4.01pm

Order Input: 4.01pm – 4.06pm

No Cancellation: 4.06pm – 4.08pm

Random Closing: 4.08pm –

4.10pm

|

SAME |

N.A. |

|

USA |

NYSE &

NASDAQ

|

9.30 am – 4.00 pm |

10.30 pm – 5.00 am |

9.30 pm – 4.00 am |

|

Australia |

ASX |

Pre-opening: 7.00am - 10.00am

Trading: 10.00am - 4.00pm

Pre-CSPA: 4:00pm - 4:10pm

Closing Single Price Auction: 4.10pm - 4.12pm

|

Pre-opening: 5.00am - 8.00am

Trading: 8.00am - 2.00pm

Pre-CSPA: 2:00pm - 2:10pm

Closing Single Price Auction: 2.10pm - 2.12pm |

Pre-opening: 4.00am - 7.00am

Trading: 7.00am - 1.00pm

Pre-CSPA: 1:00pm - 1:10pm

Closing Single Price Auction: 1.10pm - 1.12pm |

|

|

*US Daylight Saving Time - begins each year at 2 a.m. on the second Sunday of March and ends at 2 a.m. on the first Sunday of November. |

|

*Australia Daylight Saving Time - begins at 2am (AEST) on the first Sunday in October and ends at 2am (AEST) (which is 3am Australian Eastern Daylight Time) on the first Sunday in April. |

|

|

|

Cash Index CFD |

CGS-CIMB Futures Cash Index CFD allows you to trade the world’s leading indices.

The price of the Cash Index CFD is directly related to the underlying index and is derived by adjusting the Futures price by Fair Value to account for interest and dividends.

You can take a long or short view of the market and potentially profit from a move in either direction.

Using Index CFD to short the market in one trade is a great way to hedge your equity portfolio quickly and easily in times of doubt.

Trade the world's global markets, commission free via our Index CFDs. Trade long, short or even hedge your existing share portfolio with the click of a button.

Margin rates start from as low as 5% for major indices. |

|

|

|

Advantages of Cash Index CFD |

-

Transparent price, tight spreads and substantial liquidity provided by our liquidity provider

-

Clients can now trade multiple asset types in single trading account (Equity CFD & Index CFD)

-

No commission cost

-

Cash settled and non-expiring

-

No hidden expiry rollover cost

-

Minimum trade size of 1 index available except on JP225.

-

Contract value are lower than actual Index Futures therefore provides flexibility to speculate or hedge existing equity portfolio against macro market events

|

|

|

|

Cash Index CFD Product List |

Index

Code |

Underlyng

Reference

Index |

Index

Currency

* |

Traget

Spread

* |

Margin

* |

Financing

Days |

Min

Trade

Size |

Trading

Hours

(GMT) |

Order

Types |

|

AX200.IXC |

Australia

200 |

AUD |

1 |

5% |

365 |

1 |

Trading:

23.50 - 21.00

Break:

06.30 - 07.10

21.00 - 23.50 |

Price

Instruction:

Market, Limit, Stop

Lifetime

Instruction:

Good till Cancel, Date

CO Orders:

OCO, FIXEDCO, Trailing CO

|

|

CN.H.IXC |

China

H-SHARES |

HKD |

6 |

5% |

365 |

1 |

Trading:

01.15 - 19.00

Break:

04.00 - 05.00

08.30 - 09.15

19.00 - 01.15 |

|

CNA50.IXC |

China A50 |

USD |

3 |

20% |

360 |

1 |

Trading:

01.00 - 20.45

Break:

08.30 - 09.00

20.45 - 01.00 |

|

EX50.IXC |

Euro

Stoxx 50 |

EUR |

2 |

10% |

360 |

1 |

Trading:

00.15 - 20.00

Break:

20.00 - 00.15 |

|

FR40.IXC |

France

CAC 40 |

EUR |

1 |

5% |

360 |

1 |

Trading:

06.00 - 20.00

Break:

20.00 - 06.00 |

|

GR30.IXC |

Germany DAX 30 |

EUR |

1 |

5% |

360 |

1 |

Trading:

00.15 - 20.00

Break:

20.00 - 00.15 |

|

HK50.IXC |

Hong Kong Hang Seng |

HKD |

5 |

5% |

365 |

1 |

Trading:

01.15 - 19.00

Break:

04.00 - 05.00

08.30 - 09.15

19.00 - 01.15 |

|

JP225.IXC |

Japan

Nikkei 225 |

JPY |

8 |

5% |

365 |

10 |

Trading:

22.00 - 21.00

Break:

21.00 - 22.00 |

|

SING.IXC |

Singapore 30 |

SGD |

0.4 |

5% |

365 |

1 |

Trading:

00.30 - 20.45

Break:

09.10 - 09.40

20.45 - 00.30 |

|

UK100.IXC |

UK

FTSE 100 |

GBP |

1 |

5% |

365 |

1 |

Trading:

00.00 - 20.00

Break:

20.00 - 00.00 |

|

US30.IXC |

US

Dow Jones |

USD |

2 |

5% |

360 |

1 |

Trading:

22.00 - 21.00

Break:

20.15 - 20.30

21.00 - 22.00 |

|

USTEC.IXC |

US Nasdaq |

USD |

2 |

5% |

360 |

1 |

Trading:

22.00 - 21.00

Break:

20.15 - 20.30

21.00 - 22.00

|

|

US500.IXC |

US S&P |

USD |

2 |

5% |

360 |

1 |

Trading:

22.00 - 21.00

Break:

20.15 - 20.30

21.00 - 22.00 |

|

|

Trading Hours are subject to change due to Daylight Savings

|

|

*Index Currency – All profit/loss, financing and dividends will be posted in the index currency

*Target Spread – Bid/Ask spread during peak trading hours. Spreads may vary during off peak hours and certain market events

*Margin – Margin rates are subjected to change in case of volatile market conditions. Please refer to Margin Table in trading platform for latest rates |

|

|

Cash Index CFD Live market data is free and available to all CFD customers via our trading platform. Just type in /CFDINDEX in your quote screen to see live quotes for Cash Index CFD. |

|

|

|

|

|

Trading Scenarios |

|

Click here for Trading Examples

Click here for Financing Examples

Click here for Dividend Examples |

|

|

|

|

|

Getting Started with Cash Index CFD |

|

If you are an existing client, you will be able to trade Cash Index CFDs. Click on "Margin Table" button in your trading platform and search for the "IXC" Exchange

However, if "IXC" Exchange is not available in your trading platform margin table, please contact your Futures Broker’s Representative or email us at [email protected] for assistance. |

|

|

|

|

|

Commission & Financing Rates |

|

|

Commission is charged on each CFD trade and is calculated as a percentage of the full contract value of the underlying stock that is bought or sold. Financing is charged daily on any CFD position held overnight. |

|

|

|

|

|

Data Feed Charges |

|

Investors trading in other foreign market CFDs are required to subscribe for foreign market data feed.

Please click on the following schedule for details. |

|

|

|

|

|

Commission, Financing and Market Data Charges |

|

|

1. |

Currently, CFD can only be traded by sophisticated investors i.e. any person who is determined to be a sophisticated investor under the Guidelines on Categories of Sophisticated Investors issued by the Securities Commission Malaysia (“SC”). CFD is a complex leveraged product and you are advised to fully understand the risks associated with CFD before trading them. |

|

|

|

|

2. |

As an individual client, you must: |

|

|

|

|

|

|

|

3. |

As a corporate client, you must: |

|

|

|

111111 |

a. |

Certificate of Incorporation or Notice of Registration |

|

|

b. |

Memorandum and Articles of Association or Constitution (if applicable) (Where the company does not have Constitution, a written confirmation duly signed by a director that the company does not have a Constitution) |

|

|

c. |

Board Resolution |

|

|

d. |

NRIC / Passport of Directors, Authorised Persons and Shareholders with equity interest of more than 25% (both sides) |

|

|

e. |

Return giving particulars and changes in Directors, Managers & Secretaries |

|

|

f. |

Forms of Allotment of Shares |

|

|

g. |

Notice of Situation of Registered Office and of Office Hours and Particulars of Changes |

|

|

h. |

Latest Audited Accounts / Financial Statements |

-

Where applicable, submit Form W-9.

|

|

|

|

|

4. |

If you wish to subscribe for live market data feed, please submit the Market Data Subscription Form, Bursa Malaysia - Market Data Service Agreement. Please click here to view the Market Data Charges. |

|

|

|

|

5. |

Kindly visit us at: |

|

|

CGS International Future Malaysia Sdn.Bhd.

Dealing Department

Level 22, Menara IQ,

Lingkaran TRX,

Tun Razak Exchange,

55188 Kuala Lumpur

Malaysia

|

|

6. |

You may contact us at (603) 2276 8899 or email us at [email protected] |

|

|

|

|

7. |

CFD Portal Login - Click HERE (Clients only)

IRESS Viewpoint - Click HERE (FBRs only) |

1.

|

You are required to place up-front fund as an Initial Margin (the minimum value is determined by CGS International Futures Malaysia Sdn Bhd, which may differ from time to time) before trading. Please refer to Margin Table in trading platform for the latest rates.

|

|

2. |

You can deposit by: |

|

|

a. |

Interbank Fund Transfer / Payment (Online / Over-the-Counter)

-

CIMB Clicks – Perform online transfer to CGS International Futures Malaysia Sdn.Bhd.'s account with CIMB bank.

-

For online interbank fund transfer/payment, below must be stated as recipient reference:

1. CFD trading account number and

2. CFD trading account holder’s name or NRIC/Passport No.

This is to ensure that funds transferred are applied to the intended and rightful recipient.

|

|

|

b.

|

Cheque Deposit (Mininum amount RM50,000)

-

Deposit your cheque at any CIMB Bank branches via cheque deposit machines or over-the-counter channels.

-

Cheque payments must be made in the name of "CGS International Futures Malaysia Sdn Bhd for (Name of Client)".

-

All payments by cheque must be supported by documents below to facilitate verification of the identity of cheque issuer:

(i) a clear copy of cheque image and

(ii) direct bank-in form

-

If a photocopy or image of the cheque is not submitted, any charges incurred to obtain a copy of the cheque image from the bank shall be borne by client.

|

|

|

Important Note:

-

All payment must be made in favour of "CGS International Futures Malaysia Sdn Bhd for (Name of Client)". Thereafter, email the supporting document for payment to your Futures Broker's Representative.

-

Cash deposit is strictly prohibited. Clients needing to deposit cash must:

- First credit the funds into their own bank account, and

- Make payment to CGS MYF via Bank Transfer (Online/ OTC), Telegraphic Transfer (“TT”), or RENTAS.

- All payments must originate from the client’s own bank account.

-

Minimum acceptable amount for cheque deposits is RM50,000.

-

No third-party deposit is allowed.

|

|

|

Kindly also be reminded :-

-

to ensure receipt of proper documentation including daily statements and monthly statements for all transactions undertaken;

-

to verify with CGS International Futures Malaysia directly if there is any doubt on the authenticity of documents received from CGS International Futures Malaysia's licensed Futures Broker’s Representative or anyone holding out as representing CGS-CIMB Futures;

-

not to pay cash to or bank in monies directly into the bank account of CGS International Futures Malaysia Sdn Bhd's licensed Futures Broker’s Representative or anyone holding out as representing CGS International Futures Malaysia Sdn Bhd.

|

3.

|

Withdrawal

How do I withdraw my cash?

Print and complete this Withdrawal Request Form. Thereafter, email the duly signed copy to your Futures Broker’s Representative.

Please contact your respective licensed Futures Broker’s Representative or Central Dealing Team at (603) 2276 8899 should you have any enquiries.

|

CFD Investor

Q1. Who can invest in CFD?

Currently, CFD can only be traded by sophisticated investors i.e. any person who is determined to be a sophisticated investor under the Guidelines on Categories of Sophisticated Investors issued by the Securities Commission Malaysia (“SC”).

CFD Trading

Q1. How are CFD prices quoted?

CGS International Futures Malaysia CFD uses Direct Market Access (DMA).

DMA allows our CFD clients to have direct market access to the underlying security market through our CFD platform. CFD clients will be participating in the market at prices identical to that of the underlying security market.

Q2. How is the CFD contract value computed?

CFD Contract Value = Quantity of CFD contract X CFD Price

Q3. What is the contract size of CFDs?

As CGS International Futures Malaysia uses the Direct Market Access (DMA), contract size depends on the lot size that the underlying securities are traded in.

Q4. What are the trading hours for CFDs in the different markets?

Trading hours for CFDs are the same as the trading hours of the underlying securities and their respective exchanges, e.g. if the underlying security is listed on the Singapore Exchange ("SGX") the trading hours for that CFDs will be the same as the SGX trading hours.

Please refer to "Our Products" section for further details regarding trading hours.

Q5. Are the prices quoted live?

The market feed is delayed. For further details on the data feed costs, please click here and refer to the Data Feed Charges Schedule.

Q6. Are equity CFDs traded on the Stock Exchange?

No. CFD is an over-the-counter product and therefore is not traded on any exchange.

Q7. What are the counters available for CFD trading?

After logging into the CFD Trading Platform (Viewpoint), you may refer to the "Margin Watchlist" widget for tradable counters.

Q8. How long can I hold a CFD position?

There is no expiry on your CFD position. You can hold on to the position as long as you maintain the required margin, which may vary based on the daily mark-to-market pricing. You should note that financing charges are imposed on any open positions.

Please click here for Commission, Financing and Market Data Charges.

Q9. Can my CFD orders be partially filled?

Yes. The balance of the order will continue to work in the market until it is either filled or cancelled.

For markets where orders can be placed Good-for-The-Day ("GTD") only, the balance orders will be cancelled at the end of the trading day.

Q10. Can I delete or amend the CFD orders?

Yes. If the order is not done, you can either delete or amend the CFD orders.

Q11. How would I know the status of my CFD orders?

You may view your order status under the "Order Pad" window of the CFD trading platform.

Alternatively, you may refer to the close of business statement sent on the following business day.

Q12. What will happen to my CFD position if the underlying securities are suspended?

If any of the CFD underlying securities ceases to be quoted on a relevant exchange, or are under halt/suspension, CGS International Futures Malaysia may at its absolute discretion, elect to terminate the relevant CFD or vary the margin requirement for the CFD depending on the situation.

CGS International Futures Malaysia will determine the CFD Contract Value at its sole discretion upon termination.

Q13. Is short-selling allowed?

Yes. Short-selling is allowed as long as the underlying security is available for short-selling. You are able to obtain the shortable list from the “Margin Watchlist”, sort for “Y” under “AllowShort” column.

Q14. What are the underlying securities available for shorting in equity CFDs?

For equity CFDs, the list of underlying securities that can be shorted are maintained online and may vary daily.

You are encouraged to check from the margin table in the CFD online trading system.

Q15. Do I earn interest on my CFD short position?

Yes. Interest is paid based on the Base Rate less mark-up as provided in the commission and funding rates schedule.

However, if the Base Rate is low for certain markets and after factoring in the mark-up rates imposed by CGS International Futures Malaysia, you may end up paying interest for short position.

Example: If the Base Rate for SGD CFD is 0.5% p.a. and the mark-up is 3.75% p.a., you would need to pay the financing interest of 3.25% p.a. for the open short position.

Intraday trades do not incur interest. Interest is calculated based on end of day valuation of underlying position.

Q16. What are the types of collateral acceptable and what are the payment modes available?

Only cash is accepted as collateral for CFDs.

Q17. What are the costs and funding charges associated with trading in CFD?

Applicable charges are the CFD trading commission and funding charges for open CFD positions. Click on the link to find out more about the relevant charges.

Please click here to view the Commission, Financing and Market Data Charges

Q18. Are CFD clients entitled to dividends?

A trade in equity CFD is not a trade in the underlying security.

You therefore do not receive cash or other dividends directly from the issuer of the underlying security as you are not the holder of the underlying security.

You will however receive an amount equivalent to the amount of such dividends (after tax) from the CGS International Futures Malaysia, to reflect the actual dividends paid on the underlying security.

Your CFD Account will be credited or debited accordingly with such amount. Dividend adjustments are applied if you have an open position in an underlying security on the ex-dividend date.

Q19. How will corporate actions affect my CFD positions?

All corporate actions (e.g. bonus issues, capital repayments) that are applied to the underlying security will be reflected in the value of your CFD account.

To reflect the actual dividends paid on the underlying security of any equity CFD which you have entered into, on ex-date, your CFD Account will either be credited for long positions or debited on short positions with an amount equal to the value of any cash dividend.

Odd lots trading must be executed off-line through your Futures Broker’s Representative. CFDs do not confer voting rights in respect of the underlying security.

CFD Margin

Q1. What is the initial margin?

Initial margin is the margin that you must furnish in order to transact in a CFD and is calculated as a percentage of the full contract value.

Initial margin varies with different CFDs thus you would have to check online for the initial margin on the CFD that you intend to place an order on.

Q2. What is Free Equity?

Free Equity is the surplus funds in the CFD account available for creating new buy and sell positions. You will be unable to initiate new positions if your Free Equity is negative.

Q3. What is Gross Liquidation Value (GLV)?

GLV is the value of the account if all the positions are closed out at the current market price (excluding all the commission and charges).

GLV= Free Equity + Initial Margin

Q4. What is the daily mark-to-market pricing?

Mark-to-market is calculated based on the prevailing market prices of the underlying instrument. This means your initial margins required change in line with the markets movements.

Marked to Market (Initial Margin) = Quantity x Prevailing Market Price x Margin %

Q5. What is Margin Call?

A margin call occurs when you no longer have any free equity to cover the margin required to hold that position. You need to have funds in your account over and above that of the required margin to ensure you can cover any unrealised losses the position may incur.

Q6. How will I know I am subject to a margin call?

You will receive an email notification from CGS International Futures Malaysia informing you of a margin call. You may refer to the Daily Activity Statement for the amount that you are required to top up.

Q7. Can I place an order without depositing the initial margin?

No. The system will reject the order if your account has insufficient funds to meet the initial margin requirement(s).

Q8. How long do I have before my margin call positions are force sold?

If CGS International Futures Malaysia makes a margin call, you must place the amount of margin immediately or within a specified period of time which may be less than two (2) Business Days after the giving of such notice by CGS International Futures Malaysia.

CGS International Futures Malaysia has the sole discretion to force-close the outstanding CFD contracts without further notice to you if you fail to top up the required margin by the specified period of time.

Q9. How do I top up my CFD account when I receive a margin call?

Please refer to the Margin Deposit section.

CFD Daily Statement Page

|

No. |

Statement Description |

Remark |

|

1. |

Client's Name |

- |

|

2. |

Date |

Statement Date. For Daily Statements always last close of business date. |

|

3. |

Client No. |

Client’s CFD Account Number |

Journal Entries: this section show all journal entries posted to account (Financing, deposits, withdrawals and dividends.

|

No. |

Statement Description |

Remark |

|

4. |

Date |

Journal Entry Date |

|

5. |

Value Date |

Journal Value Date |

|

6. |

Journey Type |

Type of Journal Entry |

|

7. |

Description |

Narrative |

|

8. |

Reg |

Regulator code, always 01 |

|

9. |

Debit/Credit |

Amount. DR = Debit; CR = Credit |

Trades Confirmations: This section shows all the trades executed on the last business day for account. Trades are reported after merging in statement.

|

No. |

Statement Description |

Remark |

|

10. |

Date |

Trade Date |

|

11. |

Number |

Back office unique trade number |

|

12. |

Market |

Market code setup in back office system |

|

13. |

Buy |

Buy Trade Quantity |

|

14. |

Sell |

Sell Trade Quantity |

|

15. |

Contract Description |

Security name setup in back office system |

|

16. |

Trade Price |

Average Trade Price = Trades are merged based on security & side

Average Price = Sum of Trade Value/ Sum of Quantity |

|

17. |

CCY |

Currency of Trade |

|

18. |

Debit/Credit |

Commission amount of trade. DR = Debit; CR = Credit |

Purchase & Sale: This section shows closed trades in account for the last business day and realized profit/loss

|

No. |

Stetement Description |

Remark |

|

19. |

Debit/Credit |

Realized P&L on closed trades

Realized P&L = Quantity x (Sell Price – Buy Price) |

Open Positions: This section shows the open CFD positions as of last business day

|

No. |

Stetement Description |

Remark |

|

20. |

Long |

Long position quantity (Buy) |

|

21. |

Short |

Short position quantity (Sell) |

|

22. |

Settlement Price |

Last business day close price of security |

|

23. |

Average Long/Average Short |

Average price for long position/short position |

|

24. |

Debit/Credit |

Unrealized P&L on open positions

Unrealized P&L = Quantity x (Settlement Price – Average Price)

DR = Unrealized Loss; CR = Unrealized Profit |

Account Summary: This section shows financial summary of account as of last business day

|

No. |

Statement Description |

Remark |

|

25. |

Spot Rate |

End of day exchange rate ledger currency against Base currency |

|

26. |

Cash Balance B/F |

Previous day cash balance brought forward |

|

|

GST/SST/Tax |

Total GST/SST/Tax amount (if applicable) |

|

|

Interest/Finance Charge |

Total finance charge (Refer to Journal Entries section where payment type =

Interest) |

|

|

Realized Profit/Loss |

Total realized Profit or Loss (Refer to Purchase & Sales Debit/Credit) |

|

|

Deposit/Withdrawal |

Total deposits and withdrawals (Refer to Journal entries section where payment

type = Payments) |

|

|

Currency Conversion |

N/A |

|

|

Dividend |

N/A (Dividends will be posted as Payments in Journal Entries as DIV and also

reflect under Deposit/Withdrawals) |

|

|

Cash Balance C/F |

Cash Balance carried forward

Cash balance C/F = Cash balance B/F - Commission – GST – Interest +/–

Realized P&L +/– Deposit/Withdrawals |

|

|

Unrealized P&L |

Total Unrealized P&L (Refer to Open Positions section Debit/Credit) |

|

|

Total Equity |

Total Equity of Account

Cash Balance C/F +/– Unrealized P&L |

|

|

Initial Margin |

Margin requirement on open positions |

|

|

Free Equity |

Free equity available in account

Total Equity – Initial Margin

DR = deficit; CR = surplus |

Q1. How do I view my Daily Statement?